Self-employment is an achievement. But many mortgage lenders see it as a risk instead of an accomplishment when assessing for business or home mortgages.

If you’re a self-employed Calgarian, you should be proud of the business you built. You don’t need to sacrifice a focus in your business for a mortgage – either to grow your business or for a new home. Many mortgage lenders and banks consider self-employment as messy, but I don’t.

I am also self-employed, so I know the preconceptions that banks give to business owners. They are less willing to give the time and attention to review the bigger picture and give you options for mortgages that are competitive and make sense for you.

For self-employed Calgarians, I will take the time to understand your business and the goals of the mortgage so we can find the terms and payments that fit. You have options, and I’ll help you determine which is best for you – whether to grow your business or find your next home in Calgary.

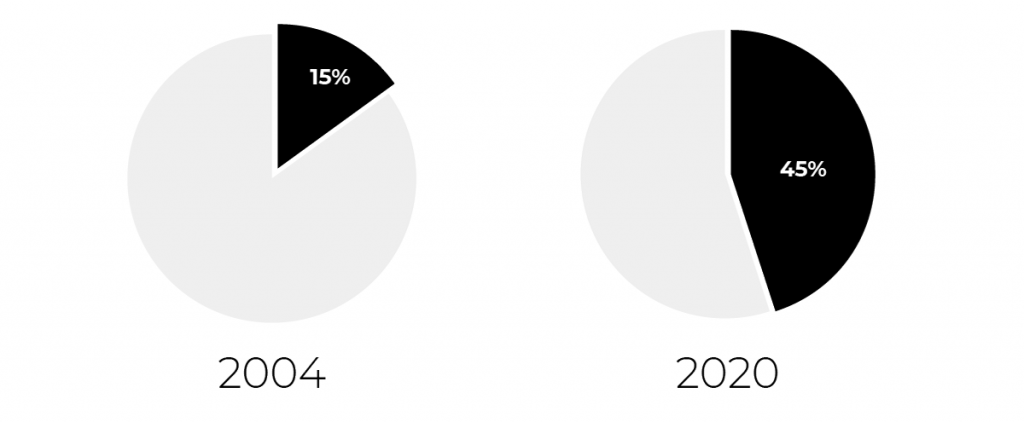

Up to 45% of Canadians will have self-employment

In 2004, there were around 2.5 million Canadians that were self-employed – or around 15%. That means 200,000 Calgarians don’t rely solely on an employer to make an income.

So if you’re self-employed, you are certainly not alone. And this group is expected to grow. If you’re considering adding self-employment to your resume, you join a large group of Calgarians.

By 2020, the number of self-employed Canadians has been predicated to jump to 45%. Nearly one-in-two Canadians is expected to find work as business owners, freelancers, or side projects to complement their current day (or night) jobs. Everyone from Uber drivers to owners of the shop down the street are using self-employment as a source of income.

In 2004, 15% of Canadians were self-employed. By 2020, it is expected that 45% of Canadians will have some form of self-employment.

Financial benefits of being your own boss

In addition to empowering individuals to set their own schedules, self-employment can offer a range of financial benefits.

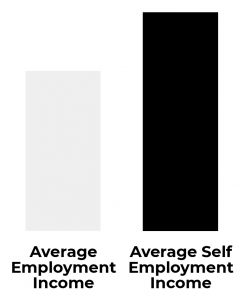

Average income of traditional employment and self-employment.

Annual earnings is on average higher than non-self-employed individuals. In 2004, the average income for traditionally employed individuals was $40,900 and the income for the self-employed was $55,600. That is an increase of over 35%.

- Self-employed individuals have more opportunities for tax reductions. They can write off expenses related to work, from travel to lunches – a perk that offsets the costs of a personal business.

- There is the potential for saving money by avoiding some of the everyday costs associated to regular employment. For example, working can home means you spend less on transportation. This not huge expenses, but eliminating a daily commute adds up – whether in driving costs or time in the CTrain to downtown. Or consider an office wardrobe: avoiding going to an office everyday will cut down on the amount of business clothing you need.

But with these benefits comes one major concern: income instability. And this instability is a red flag for many traditional mortgage lenders.

Challenges for the self-employed

Many banks consider mortgages for self-employed individuals messy because it takes an extra step to calculate income and assess risks. I understand these concerns – but not just because I’m a mortgage broker. I understand the challenges you face as a self-employed Calgarian because I am also self-employed.

Here are the factors many mortgage lenders consider red flags. I understand these challenges and I know how we can get you the best mortgage for your next home or business.

Less income (on paper)

Self-employed people invest in their business, whether through tax writeoffs or direct investments. This means that less profit is going into the personal bank account and more to run your business and help it grow.

Traditional lenders just care about your personal income. They want to make sure the debt-to-income ratio fits their risk assessments and will offer mortgage products based on a quick review of your finances.

This clearly doesn’t tell the entire story.

I will take the extra time to understand your business and where you are investing your income. Like you, I strive to be a savvy business owner that grows my personal wealth alongside my business.

I believe savvy business owners should be rewarded and recognized for focusing on business growth. I will look beyond personal income to understand the big picture.

More paperwork

Again, traditional lenders are looking for easy clients. They want a quick proof of true earning so always start with pay stubs. Considering many self-employed individuals don’t have pay stubs, this means more work for the lenders to confirm true earnings.

The truth is – it is only a little more work to determine personal income. More paperwork is not a burden to me. I’ll review your supplementary income records, such as tax records and assessments, to easily gather the information required.

And I’ll make sure it isn’t more paperwork on your end. I’ll take care of the details and focus on your mortgage, so you can focus on your business.

Higher perceived risk

Traditional lenders think you are higher risk. For you, this means mortgages with less attractive terms and rates.

You are not a higher risk to me. As your mortgage broker, I’ll take the time to understand your business and the goals of your mortgage.

Self-employment doesn’t have to restrict your mortgage options. I’ll make sure you can access better rates or terms – likely better than you’re probably expecting.

I have worked with self-employed Calgarians that came to me disheartened because their bank approached them with hesitancy – their bank treated them like a danger. I took the time to listen about their business and connected them to a mortgage that exceeded their expectations.

And I can do the same for you.

Mortgage tips for self-employed Calgarians

Whether you are looking for a mortgage today or planning for the future, here are the three tips I offer to every self-employed business owner I meet.

- Start planning early

Even if you’re just starting your business or waiting to buy a home for a few years, now is the time to plan for the future. We can create a financial plan that ensures you’ll have access to mortgages that match your dreams.

- Organize your financials

Keeping track of your business and personal financials not only helps for tax season, it will ease the process to attain a mortgage. Start a system to organize your financial documents today.

- Keep up on your taxes

Do yourself a favour and keep up on your taxes. It is the easiest way to assess your income, so filing taxes every year will ease the headache in the future.

I’m self-employed too

I have a long history of self-employment in Calgary. I am a mortgage broker, focusing on commercial and residential mortgage for Calgarians. And I am also a custom home builder and owner of MiNo Homes.

It is important to me to support Calgarians that are on the entrepreneurial journey. I understand you don’t want the additional headache of finding a suitable mortgage, so I’ll take care of the details and connect you with one of Canada’s leading lender

You can focus on your business, and I’ll take care of connecting you with a home or business mortgage.

I believe you’re not a higher risk. You are just more work for the traditional lenders. With my personal service, you can be confident in your mortgage.

Are you self-employed and looking for a mortgage in Calgary?

With one quick chat, I can tell you what to expect from the mortgage process – what paperwork, mortgage expectations and what we need to get started.

I have worked with self-employed Calgarians in all types of businesses – and I can help you too.

Call or text Abbas at 403.630.6796.